Introduction …

Looking for the Net Investment Income Tax …

The argument for why Americans abroad are required to pay the Obamacare surtax AND why foreign tax credits cannot be applied to offset the tax

Introduction …

Looking for the Net Investment Income Tax …

The argument for why Americans abroad are required to pay the Obamacare surtax AND why foreign tax credits cannot be applied to offset the tax

Marriage is a difficult relationship. That said, there are two kinds of marriages that have particular difficulties resulting form the “circumstances of a U.S. birth”.

Type 1 – A U.S. citizen married to a non-U.S. citizen

Type 2 – A non-U.S. citizen married to a U.S. citizen

(Yes, they are the same.)

I call these kinds of marriages an “FBAR Marriage“.

The problems of the “FBAR Marriage” begin with filing a tax return at all. They continue from there.

(Both the U.S. citizen and the alien need to fully understand the problems that U.S. citizenship will cause in various aspects of the marriage! Perhaps specialized pre-marriage counselling is desirable. )

See the posts referenced in the following two tweets.

Are you living outside the United States?

Are you thinking about relinquishing U.S. citizenship?

Do you have an IRA or other retirement planning account in the United States?

Are you wondering about the effect of relinquishing U.S. citizenship has on your IRA?

The answers to some of these questions will depend on what country you reside AND the tax treaty that your country has with the United States.

This post is for you!

_____________________________________________________

Introduction – In General

To quote from David Kuenzi of Thun Financial:

Introduction Expat IRAs and Roth IRAs

Even under the most conventional of circumstances, American taxpayers struggle to fully understand the myriad of tax advantaged retirement investment options they have. IRAs, 401(k)s, Roths, Individual 401(k)s, 403(b)s, deferred compensation plans, and defined benefit employer pension plans are some of the many possible investment choices from which American taxpayers might choose. Each has slightly different tax implications and a separate set of complex compliance rules, contribution limits, mandatory withdrawal requirements and other features. For Americans abroad, matters are further complicated by a broad range of special tax considerations, both U.S. and country-of-residence, that factor into the equation. The good news is that Americans abroad generally have the same opportunities as do Americans at home to accrue tax benefits from tax advantaged retirement accounts. In fact, under certain circumstances and with proper planning, U.S. expats may be able to manage their foreign residency to gain special advantage.

In this note, we guide U.S. expats to compliant and efficient use of IRAs and Roth IRAs. It also addresses the potential advantage of Roth conversion and broader oversea U.S. citizen tax strategies to use.

For the sake of simplification, this discussion assumes all traditional IRA contributions are pre-tax contributions only. The effect of U.S. state and local tax rate are not factored, except where explicitly discussed.

There are a number of issues that arise in relation to to Americans abroad and their IRAs and Roths.

Source: IRAs, Roth IRAs and the Conversion Decision for Americans Living Abroad (2018) – Thun Financial

This post introduces a range of issues which include:

1. In General: Americans abroad can invest in traditional of Roth IRAs but they can’t file their tax returns excluding their income using the FEIE

2. In General: American expatriates: The proper care and feeding of the IRA

The post is referenced in he above tweet was written by Chad and Peggy Creveling and appeared in the Wall Street Journal on August 23, 2016. It is well written and interesting. You will find some of their blog posts here. The post will NOT be of interest to “accidental Americans’ and other “long term” Americans abroad. The reason is simple. The rules are so complicated that only short term – “Homelanders Abroad” would undertake the compliance burden.

Nevertheless, I recommend the article to you. It will reinforce the difficulty of navigating U.S. tax rules if you live outside the United States.

A second post from the same authors:

3. Canada: The U.S. Canada Tax Treaty provides many benefits for Americans who move to Canada with a pre-exising Roth – it can grow forever tax free

4. Canada: How Americans moving to Canada can maximize the use of their existing Roth IRA

5. The UK: Similar benefits are available to Americans living in the UK

https://twitter.com/andygr/status/1086269396400525313

6. Canada: An IRA can be rolled into a Canadian RRSP – but be very very careful how this is done or you will erode the value of the IRA. This requires the proper integration of both U.S. and Canadian tax rules

7. In General: Relinquishment and “covered expatriates”: “Deferred compensation plans” and “Specified tax deferred accounts” are subject to particularly punitive tax treatment (full income inclusion) upon relinquishment of citizenship if the individual is a “covered expatriate” (unless a timely election is made with respect to an “eligible” deferred compensation plan)

8. In General: Relinquishment and “non-covered expatriates”: Traditional 401Ks and Roths are U.S. situs assets for the purposes of the U.S. Estate and Gift Tax

9. In Conclusion: It is essential that you get country specific advice – probably from advisors in your country of residence

https://twitter.com/andygr/status/1086296327259152384

Introduction:

The article reference in the above tweet includes:

Although 25 countries have signed a bi-national social security agreement (what the IRS calls a Totalization Agreement) with the U.S. that prevents double taxation of income with respect to social security taxes, Morocco isn’t one of them. In fact, not one country in the Middle East has signed the agreement, and Chile is the only Latin American country to do so. In Asia, only Japan and South Korea have totalization agreements with the U.S.

“The double taxation makes me crazy, especially because Morocco and the U.S. have so many treaties relating to trade, the military, and many other things,” Ms. Ponzio-Moutakki said. “This just penalizes Americans who are living abroad.”

The problem:

Self-employed “Homelanders” are required to pay a tax on self-employed earnings. This is a tax “Social Security” tax. This tax is found in the Internal Revenue Code. The Internal Revenue Code treats Americans abroad and “Homelanders” the same.

An excellent description from U.S. tax lawyer Virginia La Torre Jeker includes:

What is Self-Employment Tax?

The self-employment tax is a social security and Medicare tax based on net earnings from “self- employment”. We’ll review what it means to be “self-employed” later in this posting. The dollar threshold trigger for paying self-employment tax is quite low – you must pay self-employment tax if your net earnings from self-employment are at least US$400.

For self-employment income earned in 2013, the self-employment tax rate is 15.3% imposed on your net earnings. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance).

If you are a “self-employed” US citizen or US resident, the rules for paying self-employment tax are generally the same whether you are living in the United States or living and working overseas.

Effect of Foreign Earned Income Exclusion (FEIE)

You must take all of your self-employment income into account in figuring your net earnings from self-employment, even income that is exempt from income tax because of the FEIE. Briefly, for those who may not be familiar with the FEIE, Americans working abroad may be eligible to exclude certain foreign earned income (wages, compensation for services) from US taxable income under the rules governing the Foreign Earned Income Exclusion (FEIE), and certain foreign housing costs paid by their employers. If one is self-employed, then instead of taking a housing exclusion, a housing deduction is taken which further reduces the amount of taxable income. For self-employed persons, both the FEIE and the housing deduction will be calculated based on the individual’s net income as figured on Schedule C or Schedule F. Calculating the right amount of the exclusion depends on figuring one’s business income accurately.

The above-mentioned beneficial rules apply regardless of whether any foreign tax is paid on the foreign earned income or housing amounts. These tax benefits can be claimed, however, only if a US tax return is filed within certain time deadlines. More details can be found in my write-up here.

Therefore the question becomes:

Under what circumstances do Americans abroad become exempt from paying the U.S. “self-employment” tax? There are two possible ways to avoid the U.S. “self-employment tax”.

First – the “Totalization Agreement”

Americans abroad are exempt if they reside in a country that has a “Totalization Agreement” with the U.S. Government. So, what’s a “Totalization Agreement” and what purpose does it serve?

The short answer is that if you are “self-employed” in a country that has a “Totalization Agreement” you will NOT have to pay the U.S. Social Security tax.

This means that as a “self-employed” U.S. citizen abroad your U.S. tax liability is largely determined by your country of residence. If you don’t live in a country with a “totalization agreement” you will pay higher U.S. taxes! You cannot use your Foreign Tax Credit to offset Social Security taxes. The message is:

The takeaway: U.S. citizens abroad need to carefully consider the implications of being “self-employed”!

The Social Security site describes “Totalization Agreements” in the following way:

The Social Security Act allows the President to enter into international agreements to coordinate the U.S. Social Security Act’s title II (old age, survivors and disability) insurance programs with the social security programs of other countries. These agreements are known as “Totalization agreements.”

The United States currently has social security agreements in effect with 24 countries – Australia (2002), Austria (1991), Belgium (1984), Canada (1984), Chile (2001), Czech Republic (2009), Denmark (2008), Finland (1992), France (1988), Germany (1979), Greece (1994), Ireland (1993), Italy (1978), Japan (2005), Luxembourg (1993), the Netherlands (1990), Norway (1984), Poland (2009), Portugal (1989), South Korea (2001), Spain (1988), Sweden (1987), Switzerland (1980), and the United Kingdom (1985).

Totalization agreements have three main purposes:

To eliminate dual social security coverage and taxation. This situation occurs when a person from one country works in the other country and is required to pay social security taxes to both countries for the same work;

To avoid situations in which workers lose benefit rights because they have divided their careers between two countries. Under an agreement, such workers may qualify for partial U.S. or foreign benefits based on combined work credits from both countries.

To increase benefit portability by guaranteeing that neither country will impose restrictions on benefit payments based solely on residence or presence in the other country.

For additional information on “Totalization agreements” see: http://www.socialsecurity.gov/international/agreements_overview.html

Second – the creation of a “Foreign Corporation”

I will create a separate chapter on this issue. For the moment, borrowing again from Virginia La Torre Jeker:

Circumventing Self-Employment Tax

One method that can be considered is the creation of a foreign entity, such as a foreign corporation and being hired by that entity as an employee, generally with full salary being eligible for the FEIE and elimination of self-employment tax concerns . Whether this is a viable solution will require very careful consideration of many factors and professional tax advice should be sought. For starters, one must consider the US tax impact of owning a foreign corporation. Some initial guidance can be found in my tax blog posting here.

Introduction:

The above tweet references the following comment on a Wall Street Journal article:

Social Security is a separate program that people “pay into” every year. In return for “paying in” the U.S. agrees to “pay out” when he reaches a certain age. How is his citizenship or residence in any way related to that?

Self employed Americans abroad (unless they live in a country with a “Totalization Agreement”) are required to pay the Social Security Tax ON INCOME EARNED OUTSIDE THE UNITED STATES. Surely you would agree that they should receive the benefits even if they live outside the United States.

How is it that the “U.S. provided a livelihood” for him? Maybe he provided a “livelihood” for Americans. Maybe he “put food on the table of American families”.

Your comments remind me a little bit of President Obama’s “You didn’t build that that …”

Finally – “never getting citizenship …” There are many reasons people don’t acquire U.S. citizenship. In some cases they are citizens of countries that don’t allow dual or multiple citizenships.

This man worked. He paid into the system. He should be presumptively entitled to the benefits.

Listening in … An interesting Facebook discussion …

_______________________________________________________________________________

An identification of and “breakdown” of the issues …

General rule …

In general, Americans abroad are eligible for U.S. Social Security and eligible for having their payment sent to their country of residence. Nevertheless, because it’s the United States of America, there are always issues …

Understanding the issues …

The U.S. Government Social Security Site – Start here

This post includes a number of tweets which will reference you to “third party posts” about U.S. Social Security. Nevertheless, I strong recommend that you begin with the Official U.S. Government Social Security site. This site includes a specific “International Section“. Obviously it will always remain current. In fact, I urge you to make the Official U.S. Government site your most important “stopping point”. The site even includes an amazing tool to determine your entitlement to benefits.

An introduction:

Let’s break the “issues” into the following categories:

1. As an American Abroad, are you entitled to U.S. Social Security at all?

2. What if part of my working life was in the United States and part of it was abroad? – The impact of “Totalization Agreements”

3. As a U.S. citizen abroad, does my country of residence affect my entitlement to U.S. Social Security?

4. What if I renounce U.S. citizenship. How does that the fact that I am no longer a U.S. citizen and am now a “Non-Resident Alien” affect my entitlement to U.S. Social Security?

You become a “Non-resident alien”. Your eligibility for benefits is determined here:

See also:

Taxation of Social Security Benefits Received

5. Okay, great I am receiving U.S. Social Security payments but am living outside the United States. How are these U.S. Social Security payments taxed by the United States and/or my country of residence?

In general:

In Canada:

6. How much U.S. Social Security do I receive anyway? I have heard that there is a “Windfall elimination provision”. Is that true?

Yes it is.

Click to access EN-05-10045.pdf

See here:

cross-posted from ADCSovereignty blog

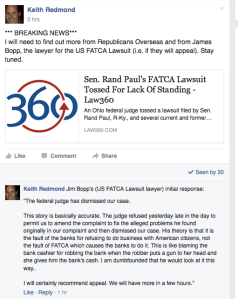

Chronology of events …

On July 14, 2015, a post at the Isaac Brock Society, detailed the pleadings in the @FATCALawsuit. In late summer, @FATCALawsuit brought a motion for a preliminary injunction to enjoin the effects of FATCA on Americans abroad. The Obama administration defended the “injunction application” (in part) on the basis that any harm to Americans abroad was the result of “self-inflicted wounds“. The application was brought before Judge Thomas Rose of the United States District Court for the Southern District of Ohio, Western Division, at Dayton. On September 30, 2015 Judge Rose denied the plaintiffs application for an injunction. On April 25, 2016, Judge Thomas Rose terminated the @FATCALawsuit brought by Jim Bopp and organized by Republicans Overseas.

The complete decision may be read here:

An early response is here:

Continue reading Judge Rose dismisses @FATCALawsuit: rules that “case is hereby TERMINATED” – Any harm NOT caused by USG but by foreign banks!

ADCT House Ways & Means Submission March 21, 2016

March 20, 2016

Charles Boustany

Chairman,

House Ways and Means Tax Policy Subcommittee

Re: “Fundamental Tax Reform Proposals”

Dear Representative Boustany:

This letter is a response to your 2016 request for “Fundamental Tax Reform Proposals”.

RECOMMENDATION: My single recommendation, made on behalf of our organization (see below) is that Congress repeal “citizenship-based taxation”, imposed on United States citizens living outside the United States, and switch to “residence-based taxation” — in keeping with the approach accepted by the rest of the civilized world.

SUPPLEMENTARY MATERIAL. In the past I, and hundreds of others, have already made submissions to the Senate Finance Committee and to the House W&M Committee in support of this recommendation.

This includes a comprehensive April 2015 submission my colleague John Richardson and I made to the “International Tax Committee” of the Senate Finance Committee.

The “International Taxation Committee” released its report on tax reform in 2015. In spite of the fact that more than 3/4 of the submissions were from overseas “Americans”, the committee acknowledged, but failed to address, the intolerable treatment of Americans citizens abroad and those deemed only by the United States to be United States citizens or “persons” abroad.

The committee did include however this statement, which we ask you to consider:

“According to working group submissions, there are currently 7.6 million American citizens living outside of the United States. Of the 347 submissions made to the international working group, nearly three-quarters dealt with the international taxation of individuals, mainly focusing on citizenship-based taxation, the Foreign Account Tax Compliance Act (FATCA), and the Report of Foreign Bank and Financial Accounts (FBAR).

While the co-chairs were not able to produce a comprehensive plan to overhaul the taxation of individual Americans living overseas within the time-constraints placed on the working group, the co-chairs urge the Chairman and Ranking Member to carefully consider the concerns articulated in the submissions moving forward.”

OUR ORGANIZATION. I submit this proposal on behalf of myself (I am a United States citizen residing in Canada for more than 40 years who will be forced to renounce United States citizenship should the tax laws affecting Americans overseas not be repealed) and on behalf of the “Alliance for the Defeat of Citizenship Taxation” (ADCT; http://www.citizenshiptaxation.ca), a non-profit corporation, for which I am Chair.

Given the reluctance of the Senate Finance and House Ways and Means committees to remedy the situation for overseas Americans, the objective of ADCT is to fight your U.S. citizenship-based taxation laws by litigation in the U.S. courts.

The provisions of the Internal Revenue Code, including various reporting requirements and punitive taxation of non-U.S. resident retirement vehicles, have forced many Americans abroad to renounce U.S. citizenship for their financial survival.

It is the view of ADCT that these direct actions of Congress result in violation of the guarantees of the 14th Amendment of the U.S. Constitution as confirmed by the United States Supreme Court in Afroyim v. Rusk.

As a result, our organization will be bringing a lawsuit in the United States to enforce the Constitutional rights of all American citizens — and specifically those who are attempting to live a normal life outside the United States.

Your subcommittee may wish to consider whether Congress has the Constitutional authority to continue to impose such tax laws on “overseas” United States citizens that compel such persons to renounce their citizenship.

Your subcommittee also needs to understand how the community of U.S. citizens abroad (the best ambassadors that America could ever have) is being destroyed.

This is not about tax compliance. It’s not about accountants and lawyers. It’s not about academics. It’s not about partisan politics. It’s not about class warfare. It is certainly not about tax evasion and offshore accounts.

It’s about people. It’s about people with real lives, who are trying to exercise their constitutional liberties to pursue happiness in the form they desire. Instead they are being forced to renounce (either formally or informally) their U.S. citizenship.

It’s about the right of people to live normal lives. It’s about being able to “live as a U.S. citizen abroad”.

Sincerely,

Stephen Kish

Chair, ADCT

John Richardson

ADCT Legal Counsel and Co-Director,

Patricia Moon

ADCT Secretary-Treasurer

Carol Tapanila

ADCT Director

Alliance for the Defeat of Citizenship Taxation

405-50 Rosehill Avenue

Toronto, ON CANADA

M4T 1G6

http://www.citizenshiptaxation.ca

John Richardson on the CRA handover of 155,000 accts 2 the IRS https://t.co/6dsx4Jb2Io #StopFATCA

— Patricia Moon (@nobledreamer16) March 17, 2016

Video is here .

cross-posted from citizenshipsolutions.ca

Ted Cruz was born in 1971 in Canada. He was therefore born a Canadian citizen. He claims to have been born to a U.S. citizen mother and was therefore a U.S. citizen by birth. (Whether he qualifies as a “

natural born citizen” is a different question.) As a Canadian citizen he had the right (prior to renouncing Canadian citizenship) to live in Canada. Had Mr. Cruz, moved back to Canada, he could have avoided the U.S. S. 877A Exit Tax. Incredible but true. It will be interesting to see whether Mr. Cruz regrets renouncing his Canadian citizenship. As you will see, by renouncing Canadian citizenship, Mr. Cruz surrendered his right to avoid the United States S. 877A Exit Tax.

Here is why …

The S. 877A Exit Tax rules in the Internal Revenue Code, are the most punitive in relation to U.S. citizens living outside the United States (AKA Americans abroad). To put it simply, with respect to Americans abroad, the S. 877A Exit Tax rules:

– operate to confiscate assets that are located in other nations; and

– operate to confiscate assets that were acquired by U.S. citizens after they moved from the United States.

There is not and has never been an “Exit Tax” anywhere else that operates in this way. The application of the S. 877A Exit Tax to assets located in other nations, is both an example of “American Exceptionalism” at its finest and a strong deterrent to exercising the right of expatriation granted in the “Expatriation Act of 1868“.

But, the “Exit Tax” applies ONLY to “Covered Expatriates” and “dual citizens from birth” can avoid being “Covered Expatriates”

…

As has been previously discussed, the Exit Tax applies ONLY to “ covered expatriates“. There are two statutory defenses to becoming a “covered expatriate”. This post is to discuss the “dual citizen from birth” defense to being treated as a “covered expatriate”. I have discovered that this defense is NOT as well known or understood as it should be.

The statute granting the “dual citizen from birth” defense to “Covered Expatriate” status reads as follows:

“It’s unjust, it’s inhumane, I didn’t choose where I was born!”

We are in year five of the Obama administration’s attempt to drag the citizens and residents of other countries into the U.S. tax net. To put it simply through FATCA (“exciting new changes in Canadian law”), a Media blitz (“Are you a U.S. Citizen, it’s time to check”), and the compliance industry (“Welcome to the U.S. Tax System”), millions of people with a “U.S. place of birth” are worried. Why are they worried?

Facts are stubborn things – The simple FATCA of the matter is:

1. Those born in the United States begin life as U.S. citizens.

2. All U.S. citizens are subject to the provisions of the U.S. Internal Revenue Code which has the practical effect of taxing people based on “place of birth”.

3. We live in a world where people have multiple citizenships and commonly change their residence from one country to another. This includes moving from their country of birth.

4. Because the United States employs “place of birth” taxation, the United States has the ability to impose direct taxation on the citizens and residents of other nations (who happen to have been born in the United States).

5. By imposing “place of birth” taxation on the citizens and residents of other nations, the United States is perfecting the art of transferring the capital of other nations to the United States Treasury.

6. The cumulative effect of this state of affairs is that U.S. “place of birth” taxation coupled with FATCA has developed into a severe interference with the sovereignty of Canada and other nations.

7. Sooner or later (probably later) the world will understand that U.S. “place of birth taxation”, is being used to extend the U.S. tax base into other nations. Should those nations object, the United States would refer to the “savings clause” in the Tax Treaty, which guarantees the right of the United States to impose taxation on those “residents and citizens” of other nations who were “Born In The USA”.

8. In other words, over time, the effect of U.S. “place of birth” taxation enforced by FATCA could be to allow the U.S. to “colonize the world”.

Continue reading Because, Not All “Accidental Americans” Are The Same! Important for @ADCSovereignty #FATCA lawsuit