John Richardson interviews Virginia La Torre Jeker on the new – November 2018 – IRS Voluntary Disclosure Practise.

Category: Uncategorized

Chapter 22: To share or not to share” – Should a U.S. citizen share a bank account with a “non-citizen AKA alien spouse? – Reporting edition

In Chapter 15 – To Be FORMWarmed Is To Be FORMArmed, we discussed the number of forms, complexity of the forms and the exposure to penalties that impact Americans abroad.

Two of the most common forms are the FBAR and Form 8938. Each of these forms requires Americans abroad to report to the U.S. Government information about their financial accounts. The reporting requirement extends to reporting accounts that are held jointly with the non-citizen spouse. This is NOT a small thing. It means that the U.S. spouse is required under threats of fines and penalty to transmit the financial information about the non-citizen spouse to the U.S. Government. The way to avoid this is for the U.S. citizen spouse to NOT hold accounts jointly with the non-citizen spouse.

The reality is that, in the case of joint accounts, this means that the U.S. citizen will report the bank accounts of the spouse to the U.S. Government. Different people have different views of this.

The following discussion take place on Keith Redmond’s American Expatriates Facebook group. This is a closed group (meaning that you would have to join the group to read the post).

The reality of life for many Americans abroad is three-fold:

1. It is common for Americans abroad to marry non-U.S. citizens;

2. Americans abroad are (with few exceptions) required to report to U.S. Financial Crimes (Think Mr. FBAR) bank accounts that they either have signing authority over or where they can control the disposition of the funds.

3. In some countries, because of FATCA, it is very difficult for U.S. citizens to be able to obtain and maintain bank accounts. This is due to a perception (rightly or wrongly) that banks do NOT want to deal with U.S. citizens.

You will see from the Facebook discussion (which assumes all three of the above points), that many Americans abroad are very reluctant to share bank and financial accounts with their non-citizen (AKA “alien”) spouse.

Possible Conclusion: At the very least you understand the implications of a U.S. citizen holding joint accounts with an alien. Separate accounts would ensure that financial information about the alien will NOT be transmitted to the IRS.

The Facebook discussion referenced in the above tweet is very interesting.

Chapter 20: The child tax credit, take it, leave it and how to take it

#CBTLawSuit Donations

“Tri-Colour”-Australia

“Grand Soleil”-Canada

Due to an exceptionally generous donor, we have forwarded $22,800 USD to our lawyer for the CBT lawsuit.

This leaves a balance due of $2200 USD in order to procure the legal opinion for the lawsuit.

Chapter 16: Most “Form Crime” penalties can be abated if there is “reasonable cause”

This will be the shortest chapter. I am certain that after having read Chapter 15 about “Form Crime” and the possible penalties (usually $10,000 a form”) you will want to know how get “Form Crime Relief”.

Speaking of $10,000 – the “Standard Form Crime Penalty”

It is important for you to know that:

– “reasonable cause” does exist as a defense; and

– If you were truly ignorant of the form (who wouldn’t be?) then you it may work for you.

First, “Form Omissions” are generally what the IRS would call “Delinquent Information Returns“.

Second, what’s “reasonable cause” anyway?

Remember, …

Many “Form Crime” penalties can be abated based on “reasonable cause”.

Chapter 13: “Married filing separately” and the “Alien Spouse” – the “hidden tax” on #Americansabroad

Marriage is a difficult relationship. That said, there are two kinds of marriages that have particular difficulties resulting form the “circumstances of a U.S. birth”.

Type 1 – A U.S. citizen married to a non-U.S. citizen

Type 2 – A non-U.S. citizen married to a U.S. citizen

(Yes, they are the same.)

I call these kinds of marriages an “FBAR Marriage“.

The problems of the “FBAR Marriage” begin with filing a tax return at all. They continue from there.

(Both the U.S. citizen and the alien need to fully understand the problems that U.S. citizenship will cause in various aspects of the marriage! Perhaps specialized pre-marriage counselling is desirable. )

See the posts referenced in the following two tweets.

Chapter 9: Receiving U.S. Social Security – #Americansabroad and entitlement

Introduction:

The above tweet references the following comment on a Wall Street Journal article:

Social Security is a separate program that people “pay into” every year. In return for “paying in” the U.S. agrees to “pay out” when he reaches a certain age. How is his citizenship or residence in any way related to that?

Self employed Americans abroad (unless they live in a country with a “Totalization Agreement”) are required to pay the Social Security Tax ON INCOME EARNED OUTSIDE THE UNITED STATES. Surely you would agree that they should receive the benefits even if they live outside the United States.

How is it that the “U.S. provided a livelihood” for him? Maybe he provided a “livelihood” for Americans. Maybe he “put food on the table of American families”.

Your comments remind me a little bit of President Obama’s “You didn’t build that that …”

Finally – “never getting citizenship …” There are many reasons people don’t acquire U.S. citizenship. In some cases they are citizens of countries that don’t allow dual or multiple citizenships.

This man worked. He paid into the system. He should be presumptively entitled to the benefits.

Listening in … An interesting Facebook discussion …

_______________________________________________________________________________

An identification of and “breakdown” of the issues …

General rule …

In general, Americans abroad are eligible for U.S. Social Security and eligible for having their payment sent to their country of residence. Nevertheless, because it’s the United States of America, there are always issues …

Understanding the issues …

The U.S. Government Social Security Site – Start here

This post includes a number of tweets which will reference you to “third party posts” about U.S. Social Security. Nevertheless, I strong recommend that you begin with the Official U.S. Government Social Security site. This site includes a specific “International Section“. Obviously it will always remain current. In fact, I urge you to make the Official U.S. Government site your most important “stopping point”. The site even includes an amazing tool to determine your entitlement to benefits.

An introduction:

Let’s break the “issues” into the following categories:

1. As an American Abroad, are you entitled to U.S. Social Security at all?

2. What if part of my working life was in the United States and part of it was abroad? – The impact of “Totalization Agreements”

3. As a U.S. citizen abroad, does my country of residence affect my entitlement to U.S. Social Security?

4. What if I renounce U.S. citizenship. How does that the fact that I am no longer a U.S. citizen and am now a “Non-Resident Alien” affect my entitlement to U.S. Social Security?

You become a “Non-resident alien”. Your eligibility for benefits is determined here:

See also:

Taxation of Social Security Benefits Received

5. Okay, great I am receiving U.S. Social Security payments but am living outside the United States. How are these U.S. Social Security payments taxed by the United States and/or my country of residence?

In general:

In Canada:

6. How much U.S. Social Security do I receive anyway? I have heard that there is a “Windfall elimination provision”. Is that true?

Yes it is.

Click to access EN-05-10045.pdf

See here:

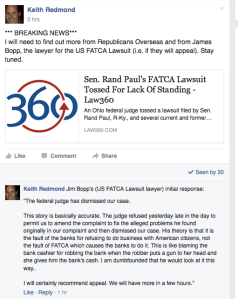

Judge Rose dismisses @FATCALawsuit: rules that “case is hereby TERMINATED” – Any harm NOT caused by USG but by foreign banks!

cross-posted from ADCSovereignty blog

Chronology of events …

On July 14, 2015, a post at the Isaac Brock Society, detailed the pleadings in the @FATCALawsuit. In late summer, @FATCALawsuit brought a motion for a preliminary injunction to enjoin the effects of FATCA on Americans abroad. The Obama administration defended the “injunction application” (in part) on the basis that any harm to Americans abroad was the result of “self-inflicted wounds“. The application was brought before Judge Thomas Rose of the United States District Court for the Southern District of Ohio, Western Division, at Dayton. On September 30, 2015 Judge Rose denied the plaintiffs application for an injunction. On April 25, 2016, Judge Thomas Rose terminated the @FATCALawsuit brought by Jim Bopp and organized by Republicans Overseas.

The complete decision may be read here:

An early response is here:

Continue reading Judge Rose dismisses @FATCALawsuit: rules that “case is hereby TERMINATED” – Any harm NOT caused by USG but by foreign banks!

ADCT Submission to House Ways & Means Committee March 21, 2016

ADCT House Ways & Means Submission March 21, 2016

March 20, 2016

Charles Boustany

Chairman,

House Ways and Means Tax Policy Subcommittee

Re: “Fundamental Tax Reform Proposals”

Dear Representative Boustany:

This letter is a response to your 2016 request for “Fundamental Tax Reform Proposals”.

RECOMMENDATION: My single recommendation, made on behalf of our organization (see below) is that Congress repeal “citizenship-based taxation”, imposed on United States citizens living outside the United States, and switch to “residence-based taxation” — in keeping with the approach accepted by the rest of the civilized world.

SUPPLEMENTARY MATERIAL. In the past I, and hundreds of others, have already made submissions to the Senate Finance Committee and to the House W&M Committee in support of this recommendation.

This includes a comprehensive April 2015 submission my colleague John Richardson and I made to the “International Tax Committee” of the Senate Finance Committee.

The “International Taxation Committee” released its report on tax reform in 2015. In spite of the fact that more than 3/4 of the submissions were from overseas “Americans”, the committee acknowledged, but failed to address, the intolerable treatment of Americans citizens abroad and those deemed only by the United States to be United States citizens or “persons” abroad.

The committee did include however this statement, which we ask you to consider:

“According to working group submissions, there are currently 7.6 million American citizens living outside of the United States. Of the 347 submissions made to the international working group, nearly three-quarters dealt with the international taxation of individuals, mainly focusing on citizenship-based taxation, the Foreign Account Tax Compliance Act (FATCA), and the Report of Foreign Bank and Financial Accounts (FBAR).

While the co-chairs were not able to produce a comprehensive plan to overhaul the taxation of individual Americans living overseas within the time-constraints placed on the working group, the co-chairs urge the Chairman and Ranking Member to carefully consider the concerns articulated in the submissions moving forward.”

OUR ORGANIZATION. I submit this proposal on behalf of myself (I am a United States citizen residing in Canada for more than 40 years who will be forced to renounce United States citizenship should the tax laws affecting Americans overseas not be repealed) and on behalf of the “Alliance for the Defeat of Citizenship Taxation” (ADCT; http://www.citizenshiptaxation.ca), a non-profit corporation, for which I am Chair.

Given the reluctance of the Senate Finance and House Ways and Means committees to remedy the situation for overseas Americans, the objective of ADCT is to fight your U.S. citizenship-based taxation laws by litigation in the U.S. courts.

The provisions of the Internal Revenue Code, including various reporting requirements and punitive taxation of non-U.S. resident retirement vehicles, have forced many Americans abroad to renounce U.S. citizenship for their financial survival.

It is the view of ADCT that these direct actions of Congress result in violation of the guarantees of the 14th Amendment of the U.S. Constitution as confirmed by the United States Supreme Court in Afroyim v. Rusk.

As a result, our organization will be bringing a lawsuit in the United States to enforce the Constitutional rights of all American citizens — and specifically those who are attempting to live a normal life outside the United States.

Your subcommittee may wish to consider whether Congress has the Constitutional authority to continue to impose such tax laws on “overseas” United States citizens that compel such persons to renounce their citizenship.

Your subcommittee also needs to understand how the community of U.S. citizens abroad (the best ambassadors that America could ever have) is being destroyed.

This is not about tax compliance. It’s not about accountants and lawyers. It’s not about academics. It’s not about partisan politics. It’s not about class warfare. It is certainly not about tax evasion and offshore accounts.

It’s about people. It’s about people with real lives, who are trying to exercise their constitutional liberties to pursue happiness in the form they desire. Instead they are being forced to renounce (either formally or informally) their U.S. citizenship.

It’s about the right of people to live normal lives. It’s about being able to “live as a U.S. citizen abroad”.

Sincerely,

Stephen Kish

Chair, ADCT

John Richardson

ADCT Legal Counsel and Co-Director,

Patricia Moon

ADCT Secretary-Treasurer

Carol Tapanila

ADCT Director

Alliance for the Defeat of Citizenship Taxation

405-50 Rosehill Avenue

Toronto, ON CANADA

M4T 1G6

http://www.citizenshiptaxation.ca

John Richardson on CBC Newsworld’s The Exchange

John Richardson on the CRA handover of 155,000 accts 2 the IRS https://t.co/6dsx4Jb2Io #StopFATCA

— Patricia Moon (@nobledreamer16) March 17, 2016

Video is here .