“Tri-Colour”-Australia

“Grand Soleil”-Canada

Due to an exceptionally generous donor, we have forwarded $22,800 USD to our lawyer for the CBT lawsuit.

This leaves a balance due of $2200 USD in order to procure the legal opinion for the lawsuit.

Judge Rose dismisses @FATCALawsuit: rules that “case is hereby TERMINATED” – Any harm NOT caused by USG but by foreign banks!

cross-posted from ADCSovereignty blog

Chronology of events …

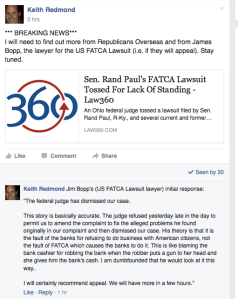

On July 14, 2015, a post at the Isaac Brock Society, detailed the pleadings in the @FATCALawsuit. In late summer, @FATCALawsuit brought a motion for a preliminary injunction to enjoin the effects of FATCA on Americans abroad. The Obama administration defended the “injunction application” (in part) on the basis that any harm to Americans abroad was the result of “self-inflicted wounds“. The application was brought before Judge Thomas Rose of the United States District Court for the Southern District of Ohio, Western Division, at Dayton. On September 30, 2015 Judge Rose denied the plaintiffs application for an injunction. On April 25, 2016, Judge Thomas Rose terminated the @FATCALawsuit brought by Jim Bopp and organized by Republicans Overseas.

The complete decision may be read here:

An early response is here:

Continue reading Judge Rose dismisses @FATCALawsuit: rules that “case is hereby TERMINATED” – Any harm NOT caused by USG but by foreign banks!

ADCT Submission to House Ways & Means Committee March 21, 2016

ADCT House Ways & Means Submission March 21, 2016

March 20, 2016

Charles Boustany

Chairman,

House Ways and Means Tax Policy Subcommittee

Re: “Fundamental Tax Reform Proposals”

Dear Representative Boustany:

This letter is a response to your 2016 request for “Fundamental Tax Reform Proposals”.

RECOMMENDATION: My single recommendation, made on behalf of our organization (see below) is that Congress repeal “citizenship-based taxation”, imposed on United States citizens living outside the United States, and switch to “residence-based taxation” — in keeping with the approach accepted by the rest of the civilized world.

SUPPLEMENTARY MATERIAL. In the past I, and hundreds of others, have already made submissions to the Senate Finance Committee and to the House W&M Committee in support of this recommendation.

This includes a comprehensive April 2015 submission my colleague John Richardson and I made to the “International Tax Committee” of the Senate Finance Committee.

The “International Taxation Committee” released its report on tax reform in 2015. In spite of the fact that more than 3/4 of the submissions were from overseas “Americans”, the committee acknowledged, but failed to address, the intolerable treatment of Americans citizens abroad and those deemed only by the United States to be United States citizens or “persons” abroad.

The committee did include however this statement, which we ask you to consider:

“According to working group submissions, there are currently 7.6 million American citizens living outside of the United States. Of the 347 submissions made to the international working group, nearly three-quarters dealt with the international taxation of individuals, mainly focusing on citizenship-based taxation, the Foreign Account Tax Compliance Act (FATCA), and the Report of Foreign Bank and Financial Accounts (FBAR).

While the co-chairs were not able to produce a comprehensive plan to overhaul the taxation of individual Americans living overseas within the time-constraints placed on the working group, the co-chairs urge the Chairman and Ranking Member to carefully consider the concerns articulated in the submissions moving forward.”

OUR ORGANIZATION. I submit this proposal on behalf of myself (I am a United States citizen residing in Canada for more than 40 years who will be forced to renounce United States citizenship should the tax laws affecting Americans overseas not be repealed) and on behalf of the “Alliance for the Defeat of Citizenship Taxation” (ADCT; http://www.citizenshiptaxation.ca), a non-profit corporation, for which I am Chair.

Given the reluctance of the Senate Finance and House Ways and Means committees to remedy the situation for overseas Americans, the objective of ADCT is to fight your U.S. citizenship-based taxation laws by litigation in the U.S. courts.

The provisions of the Internal Revenue Code, including various reporting requirements and punitive taxation of non-U.S. resident retirement vehicles, have forced many Americans abroad to renounce U.S. citizenship for their financial survival.

It is the view of ADCT that these direct actions of Congress result in violation of the guarantees of the 14th Amendment of the U.S. Constitution as confirmed by the United States Supreme Court in Afroyim v. Rusk.

As a result, our organization will be bringing a lawsuit in the United States to enforce the Constitutional rights of all American citizens — and specifically those who are attempting to live a normal life outside the United States.

Your subcommittee may wish to consider whether Congress has the Constitutional authority to continue to impose such tax laws on “overseas” United States citizens that compel such persons to renounce their citizenship.

Your subcommittee also needs to understand how the community of U.S. citizens abroad (the best ambassadors that America could ever have) is being destroyed.

This is not about tax compliance. It’s not about accountants and lawyers. It’s not about academics. It’s not about partisan politics. It’s not about class warfare. It is certainly not about tax evasion and offshore accounts.

It’s about people. It’s about people with real lives, who are trying to exercise their constitutional liberties to pursue happiness in the form they desire. Instead they are being forced to renounce (either formally or informally) their U.S. citizenship.

It’s about the right of people to live normal lives. It’s about being able to “live as a U.S. citizen abroad”.

Sincerely,

Stephen Kish

Chair, ADCT

John Richardson

ADCT Legal Counsel and Co-Director,

Patricia Moon

ADCT Secretary-Treasurer

Carol Tapanila

ADCT Director

Alliance for the Defeat of Citizenship Taxation

405-50 Rosehill Avenue

Toronto, ON CANADA

M4T 1G6

http://www.citizenshiptaxation.ca

John Richardson on CBC Newsworld’s The Exchange

John Richardson on the CRA handover of 155,000 accts 2 the IRS https://t.co/6dsx4Jb2Io #StopFATCA

— Patricia Moon (@nobledreamer16) March 17, 2016

Video is here .

Why the S. 877A(g)(1)(B) “dual citizen exemption” encourages dual citizens from birth to remain US citizens and others (except @SenTedCruz) to renounce

cross-posted from citizenshipsolutions.ca

Ted Cruz was born in 1971 in Canada. He was therefore born a Canadian citizen. He claims to have been born to a U.S. citizen mother and was therefore a U.S. citizen by birth. (Whether he qualifies as a “

natural born citizen” is a different question.) As a Canadian citizen he had the right (prior to renouncing Canadian citizenship) to live in Canada. Had Mr. Cruz, moved back to Canada, he could have avoided the U.S. S. 877A Exit Tax. Incredible but true. It will be interesting to see whether Mr. Cruz regrets renouncing his Canadian citizenship. As you will see, by renouncing Canadian citizenship, Mr. Cruz surrendered his right to avoid the United States S. 877A Exit Tax.

Here is why …

The S. 877A Exit Tax rules in the Internal Revenue Code, are the most punitive in relation to U.S. citizens living outside the United States (AKA Americans abroad). To put it simply, with respect to Americans abroad, the S. 877A Exit Tax rules:

– operate to confiscate assets that are located in other nations; and

– operate to confiscate assets that were acquired by U.S. citizens after they moved from the United States.

There is not and has never been an “Exit Tax” anywhere else that operates in this way. The application of the S. 877A Exit Tax to assets located in other nations, is both an example of “American Exceptionalism” at its finest and a strong deterrent to exercising the right of expatriation granted in the “Expatriation Act of 1868“.

But, the “Exit Tax” applies ONLY to “Covered Expatriates” and “dual citizens from birth” can avoid being “Covered Expatriates”

…

As has been previously discussed, the Exit Tax applies ONLY to “ covered expatriates“. There are two statutory defenses to becoming a “covered expatriate”. This post is to discuss the “dual citizen from birth” defense to being treated as a “covered expatriate”. I have discovered that this defense is NOT as well known or understood as it should be.

The statute granting the “dual citizen from birth” defense to “Covered Expatriate” status reads as follows:

Because, Not All “Accidental Americans” Are The Same! Important for @ADCSovereignty #FATCA lawsuit

“It’s unjust, it’s inhumane, I didn’t choose where I was born!”

We are in year five of the Obama administration’s attempt to drag the citizens and residents of other countries into the U.S. tax net. To put it simply through FATCA (“exciting new changes in Canadian law”), a Media blitz (“Are you a U.S. Citizen, it’s time to check”), and the compliance industry (“Welcome to the U.S. Tax System”), millions of people with a “U.S. place of birth” are worried. Why are they worried?

Facts are stubborn things – The simple FATCA of the matter is:

1. Those born in the United States begin life as U.S. citizens.

2. All U.S. citizens are subject to the provisions of the U.S. Internal Revenue Code which has the practical effect of taxing people based on “place of birth”.

3. We live in a world where people have multiple citizenships and commonly change their residence from one country to another. This includes moving from their country of birth.

4. Because the United States employs “place of birth” taxation, the United States has the ability to impose direct taxation on the citizens and residents of other nations (who happen to have been born in the United States).

5. By imposing “place of birth” taxation on the citizens and residents of other nations, the United States is perfecting the art of transferring the capital of other nations to the United States Treasury.

6. The cumulative effect of this state of affairs is that U.S. “place of birth” taxation coupled with FATCA has developed into a severe interference with the sovereignty of Canada and other nations.

7. Sooner or later (probably later) the world will understand that U.S. “place of birth taxation”, is being used to extend the U.S. tax base into other nations. Should those nations object, the United States would refer to the “savings clause” in the Tax Treaty, which guarantees the right of the United States to impose taxation on those “residents and citizens” of other nations who were “Born In The USA”.

8. In other words, over time, the effect of U.S. “place of birth” taxation enforced by FATCA could be to allow the U.S. to “colonize the world”.

Continue reading Because, Not All “Accidental Americans” Are The Same! Important for @ADCSovereignty #FATCA lawsuit

John Richardson on CTV “Power Play” with Don Martin today

UPDATE: The full interview segment with John is now available on the Isaac Brock Society YouTube channel

LIVE: Citizenship Lawyer John Richardson discusses how dual-citizens in Canada are navigating the American tax system. #cdnpoli #ctvpp

— CTV Power Play (@CTV_PowerPlay) February 10, 2016

Richardson says it’s very difficult to do reasonable retirement planning if you are a Canadian who also holds US citizenship #cdnpoli #ctvpp

— CTV Power Play (@CTV_PowerPlay) February 10, 2016

John Richardson will be interviewed today by Don Martin on CTV’s Power Play.The show airs from 5:00 – 6:00 pm EDT. We expect his segment to be somewhere around the 5:30 pm mark. Please pass the word, particularly to those who may not appreciate the reality of this situation.

PODCAST (audio only)

View the video online need a Bell Media account

With thanks to our resident expert Deckard1138 for capturing, editing and posting this!

Solving US Citizenship Problems: Accidental Americans Sat Jan 23 2016

UPDATE JANUARY 21, 2016

WHAT: Solving U.S. Citizenship Problems: Accidental Americans

WHEN: Saturday January 23, 2016, 2:00-4:00 pm EST

This meeting is being moved online/conference call via UberConference and will make it possible to participate from outside the Toronto area. Please pass the word!

REGISTRATION & ADMISSION: please register by submitting admission cost of $20.00 CAD via Paypal to: information@cbtlawsuit.ca

Please note you do not have to be a member of Paypal in order to pay/register.

Once registration is complete we will email you the details of how to log in, etc.

Generally, an Accidental American is:

A citizen of a country other than the United States who may also be considered a U.S. citizen under U.S. nationality law but is not aware of having U.S. status, or has only become aware of it recently during adulthood.

* born outside the US/in their own country due to their parents’ U.S. status; OR

* born inside the U.S. to non-U.S. parents residing in the country temporarily for work or study and then return to their own country in their early childhood OR

* born inside the U.S. but adopted by parents who live in other countries,

Most people simply accept that the U.S. has the right to proclaim they are American. Others are questioning whether the U.S. can impose citizenship on someone born outside the country who does not want it and had no choice in the matter (even if his/her parent(s) registered their birth with the American consulate). There is a court case in India where a father is being sued by his son for registering his birth in the U.S. while the father was there on a work visa.

All Americans are required to report their worldwide income and file tax as well as information returns if living outside the US. This includes Accidentals even if:

* they have never actually lived in the U.S., whether for employment, education, etc.

* they have never had a Social Security number, a passport, voted or filed taxes

Due to the long, porous border between Canada and the United States, the highest number of accidental Americans is likely to be found in Canada.

Children were often born in the US because the only hospital was on the other side of the border, then returning to Canada after a few days to live out the rest of their lives as Canadians (only). The United States “claims” these people and are aggressively trying to locate them via FATCA/IGA reporting.

Given the fact that the U.S. never enforced the law, never engaged in an effective outreach program to let people know of their obligations, it is particularly upsetting to these individuals that they are expected to file and pay in the same way as those who are resident in the United States.

And yet, If they wish to end their U.S. citizenship, they are required to come into tax compliance for the 5 years prior to their renunciation, complete form 8854, swear all requirements have been completed under penalty of perjury and pay the $2350 USD fee to the Department of State in order to receive a CLN. Any tax be due and the fees from the accountant or tax lawyer of course, would be added.

The program will explore various options available for consideration. Please join us in order to get the facts before you take action!

WHEN: Saturday, January 23, 2016 2:00 – 4:00 pm EST

WHERE: UberConference

REGISTRATION & ADMISSION: Please register by submitting admission cost of $20.00 CAD via Paypal (https://www.paypal.com/ca/webapps/mpp/home ) to: information@cbtlawsuit.ca Please note you do not have to be a member of Paypal in order to pay/register. Once registration is complete we will email you the details of how to log in, etc.

WHO: John Richardson, B.A., LL.B., J.D. (Of the bars of Ontario, New York and Massachusetts), Toronto citizenship lawyer- citizenshipsolutions.ca and Co-chair of the Alliance for the Defence of Canadian Sovereignty & the Alliance for the Defeat of Citizenship Taxation

Information presented is NOT intended or offered as legal or accounting advice specific to your situation.

While some Homelanders have a private tax system – USA imposes FATCA and CookvTait on #Americansabroad

Cross posted from the RenouceUScitizenship blog.

A FATCA fairy tale …

A “Bed Time story” explaining why FATCA does not matter in the least for those it was supposedly intended to target!

Once upon a time in America –

There were some homelanders who didn’t pay their fair share!

Most of the taxes were paid by higher income earning homelanders!

Unless you were a “super wealthy” homelander in which case you could create your own special tax system and pay the lowest taxes of all!

Which created many revenue shortfalls. So Congress passed laws to benefit Homelanders and forced Americans abroad to pay for those benefits, by including “Revenue Offsets” in those laws.

The President asked:

“Mirror, Mirror on the wall. What’s the greatest “Revenue Offset” of them all?”

The Face In The Mirror Answered:

The greatest “Revenue Offset of Them All” is FATCA. FATCA is the “gift that just keeps on giving”.

And the President signed FATCA and sent the IRS to hunt Americans abroad with the greatest “Revenue Offset Provision Of Them All”

Donation Acknowledgements

Thank you for recent donations from:

“Tri-Colour”-Australia

“Grand Soleil”-Canada

UPDATE JUNE 10, 2016

TOTAL RECEIVED:

CAD $15,816.46

TOTAL RECEIVED:

USD $ 1,150.00

TOTAL # of DONATIONS: 100

Thanks to David Pinto for encouraging donations.

Until we have enough witnesses for the next stage of the Canadian suit, our main fundraiser will be busy. Once that has been established, we will be more pro-active regarding movement on the CBT lawsuit.

We appreciate your patience and support (esp Australia-WOW!)

WITH THANKS TO OUR DONORS FROM:

AUSTRALIA 23

BELGIUM 2

CANADA 9

FRANCE 3

GERMANY 9

HONG KONG 3

ICELAND 1

ITALY 1

NETHERLANDS 2

NEW ZEALAND 1

NORWAY 2

SLOVENIA 2

SWEDEN 2

SWITZERLAND 9

THAILAND 1

UK 15

UAE 1

US 14

The Alliance for the Defeat of Citizenship Taxation (ADCT)

- announces the “roll out” of a lawsuit filed in the United States

- against the Government of the United States

- to strike down the most egregious aspects of U.S. “place of birth taxation”

- and provide relief for those who reside outside the United States and are unjustly, unfairly and unlawfully burdened by the attempt of the United States to impose its laws on the residents and/or citizens of other nations

- The lawsuit will require a large amount of funding including an immediate injection of $25,000.

- Twitter: @CitizenshipTax

- Twitter: @CBTLawsuit

Alliance for the Defeat of Citizenship Taxation is the sister organization to Alliance for the Defence of Canadian Sovereignty

(sponsoring the “FATCA” IGA lawsuit in Canada – collected over $500,000 CAD to fund the legal challenge)

(Numbers after country represent the number of donations, NOT the the number of donors)

*******

UPDATE MARCH 28, 2016

TOTAL RECEIVED:

CAD $11,971.01

TOTAL RECEIVED:

USD $ 1,150.00

TOTAL # of DONATIONS: 73

WITH THANKS TO OUR DONORS FROM:

AUSTRALIA 16

BELGIUM 1

CANADA 6

FRANCE 2

GERMANY 7

HONG KONG 1

ICELAND 1

ITALY 1

NETHERLANDS 2

NORWAY 1

SLOVENIA 2

SWEDEN 1

SWITZERLAND 4

THAILAND 1

UK 12

UAE 1

US 14

The Alliance for the Defeat of Citizenship Taxation (ADCT)

- announces the “roll out” of a lawsuit filed in the United States

- against the Government of the United States

- to strike down the most egregious aspects of U.S. “place of birth taxation”

- and provide relief for those who reside outside the United States and are unjustly, unfairly and unlawfully burdened by the attempt of the United States to impose its laws on the residents and/or citizens of other nations

- The lawsuit will require a large amount of funding including an immediate injection of $25,000.

- Twitter: @CitizenshipTax

- Twitter: @CBTLawsuit

Alliance for the Defeat of Citizenship Taxation is the sister organization to Alliance for the Defence of Canadian Sovereignty

(sponsoring the “FATCA” IGA lawsuit in Canada – collected over $500,000 CAD to fund the legal challenge)

(Numbers after country represent the number of donations, NOT the the number of donors)

*******

UPDATE – MARCH 8 2016

TOTAL RECEIVED: $11,491.11 CAD

TOTAL RECEIVED: $1,150.00 USD

*******

UPDATE – FEBRUARY 19 2016

TOTAL RECEIVED: $10,892.36 CAD

TOTAL RECEIVED: $1,150.00 USD

PENDING: £40 GBP

A HUGE Thank you to an ongoing donor from Australia!

*****

UPDATE – FEBRUARY 18 2016

With thanks to “Puffin” – arrived safe and sound. We really appreciate it!

UPDATE – FEBRUARY 13 2016

TOTAL RECEIVED: $10,748.51CAD

TOTAL RECEIVED: 150.00 USD

UPDATE – JANUARY 21 2016

MANY THANKS TO BillyJack! Arrived safe & sound!

UPDATE – JANUARY 17 2016

MANY THANKS TO “SLOVENIA” & “OLD FRIEND NEW HOPE”!

UPDATE JANUARY 8, 2016

TOTAL CAD MORE THAN JUST DOUBLED!

WE CAN DO THIS!

TOTAL RECEIVED: $9,661.84 CAD

TOTAL RECEIVED: 150.00 USD

TOTAL # of DONATIONS: 54

Thanks today to “Slovenia” & “5K” – Much Appreciated!

WITH THANKS TO OUR DONORS FROM:

Australia 8

Belgium 1

Canada 3

France 1

Germany 7

Hong Kong 1

Iceland 1

Italy 1

NL 2

Norway 1

Slovenia 1

Sweden 1

Switzerland 4

Thailand 1

UAE 1

UK 8

USA 12

(Numbers after country represent the number of donations, not the the number of donors)

Please visit our new website:

http://www.citizenshiptaxation.ca

For Donations: http://bit.ly/1Sy6eRk

Contact us:

information@citizenshiptaxation.ca

*****